Uncover Understand Advise

GDPR Compliant InsuranceGPT helps you respond to customers more effectively

Simplifai InsuranceGPT is a custom-built GPT tool, fuelled by our revolutionary no-code AI-powered platform. It strengthens end-to-end business process automation capabilities, providing enriched communication between insurers and their customers through the power of generative AI – delivering fast, concise, and accurate responses in a secure way.

A Focused Generative AI Solution to address Insurance Complexities

In the rapidly evolving landscape of the insurance sector, businesses are consistently challenged with navigating complex data systems, maintaining strict data privacy, and ensuring accurate communication with their clients. Recognizing these pressing issues, Simplifai offers a focused solution: InsuranceGPT.

Complex System Integration

- Insurance companies often deal with fragmented and intricate systems, hindering efficient claims management and policy administration. The friction in accessing and processing this data can lead to delays and inaccuracies.

- InsuranceGPT seamlessly integrates into existing ecosystems, collaborating with third-party services and industry platforms to streamline data retrieval and enhance customer service.

Data Security and Privacy Concerns

- With increasing cyber threats and stringent regulatory requirements like GDPR, insurance firms are under constant pressure to protect their clients’ data.

- Prioritizing data security, InsuranceGPT is built upon Simplifai’s commitment to safeguarding privacy. Our strict adherence to GDPR and the model’s design for privacy assurance ensure that clients’ data is always protected.

Need for Sector-Specific Knowledge

- Generalized AI models might not always grasp the nuances of insurance-related queries, leading to potential miscommunication and misinformation.

- Training InsuranceGPT specifically on insurance-relevant information ensures a deeper understanding of industry-specific jargon, processes, and concerns. This makes it exceptionally adept at providing accurate and relevant responses

Amplifying value-creation with InsuranceGPT

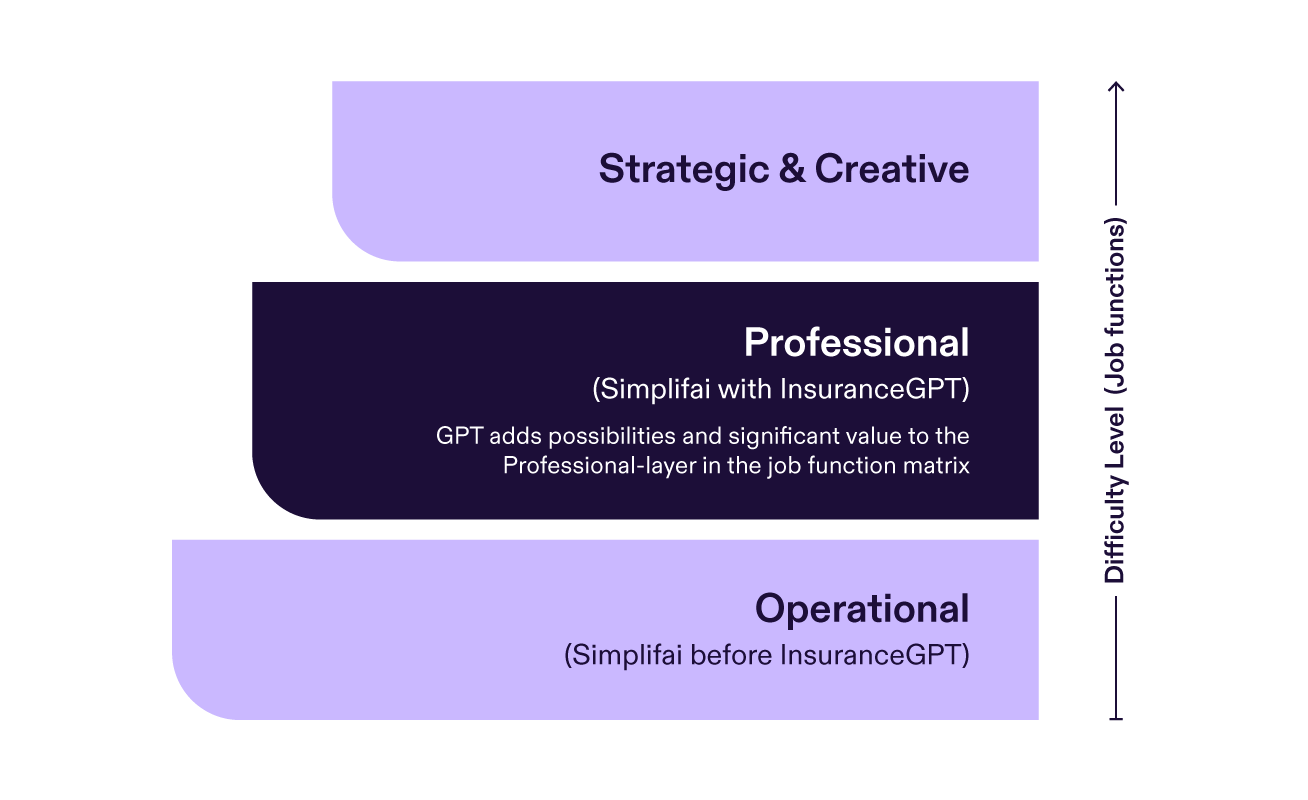

In the complex world of claims settlements, talent recruitment and retention are challenging. InsuranceGPT revolutionizes this, enhancing expert capabilities and becoming an organizational asset. Our innovative technology goes beyond productivity, unlocking 10x value for customers by managing larger volumes and intricate high-value tasks.

GPT represents a natural expansion of the current offering, allowing significantly increased value creation.

InsuranceGPT based Advanced Claims Handling solution

One of the most prominent use cases of InsuranceGPT is advanced claims handling, a task traditionally done by professionals with legal knowledge. Based on its training, InsuranceGPT can perform the following tasks:

- Shortlist similar/relevant cases in historical database.

- claims settlement decision support,approve/reject claim based on law/historical decisions.

- Automatic information search/lookup.

- Read and write the case correspondence and documentations.

Areas of Application for InsuranceGPT

Customer/Client communication

Control and Verification

Marketing / Outbound communication

Sales support

Creative writing

Decision support

Simplifai InsuranceGPT: A cut above the rest

Maintaining ‘No code necessary’– Simplifai’s no-code model allows businesses to seamlessly integrate to the platform, without the need for tech expertise, increasing efficiency and speed of use.

Performance focused- Being trained on insurance-related data, it has a superior understanding of insurance terminologies, rules, and processes, enabling it to interpret and respond to a broad array of queries with impressive speed and accuracy.

Business value focused– To build services tailored to the specific and regulated requirements of insurers, we have also established a customer reference board with leading names within the insurance sector to ensure product development is in line with customer requirements.

Customer Feedback

“Van Ameyde’s Claims platform, ECHO, has already benefited from the best-in-class AI automation that the Simplifai partnership provides. In addition, Simplifai’s expansion to GPT technology will further solidify our leading position in the claims handling space. In order to even consider Simplifai as a partner, we also needed to ensure their continued strategic focus on security and compliance, as well.”

“The evolution of technology is not slowing down with the rapid development of AI and LLMs. That is why we are joining the reference board and taking a front seat together with Simplifai, to explore both current and future opportunities for responsibly leveraging AI and new technologies to improve our operational efficiency and customer experience. This is not the time to fall behind.”